A graph maker is a tool that is used to create graphs from information contained within a spreadsheet. They can be a very important part of any business’ money management system, as they provide a visual aspect to the data that often makes it easier for people to understand what’s going on. For instance, if you use seasonality in your finances and you have one graph per month showing things like profit, sales revenue, expenses, and so forth, then having everything laid out visually can make it much easier for you to see where the gaps are in your income or expenditure. So here we have mentioned 13 benefits of graph maker for finances, read them thoroughly.

1. A graph creator can help you visualize your financial situation.

This is probably one of the most important benefits of using a graph maker for your finances. When you can see your finances laid out in front of you, it can be easier to understand where you need to make changes.

2. A-line graph maker can help you spot trends in your spending and saving.

If you use a graph maker to track your finances over time, you may be able to notice trends that you otherwise would not have noticed. This information can help you make better decisions about how to spend and save your money.

3. A graph maker can help you plan for future expenses.

If you know when your next big expense will come around, then you have time to plan for that expense. If you have a graph maker, however, then you may see when your next big expense is coming up using the data provided by your graphs.

4. A graph maker can help you work out what has caused changes in your finances.

If your profit suddenly drops or spikes, for instance, this information could be an indicator of something potentially being wrong with your business’ finances if there are no major events (like seasonal variation) causing it. Looking at the numbers on the spreadsheet itself may not provide enough insight into why this drop or spike occurred, but a graph maker could provide more information on this topic.

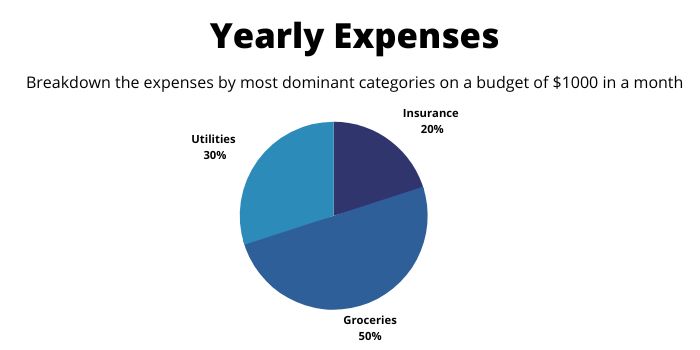

Use a pie chart generator from Venngage to also help you visualize your current financial status.

5. A chart maker can help you work out your ideal business model.

A graph maker can show you how various aspects of your business, such as profit margin and sales revenue, vary with one another depending upon the variables that you change in your spreadsheet. This allows you to find the sweet spot where those variables result in the optimal balance between them. If any aspect of your business results in a less favorable balance, then there may be a flaw in at least one aspect of your business model. Being able to spot these problems early will save you a lot of pain later on down the line when something finally goes wrong and causes serious harm to your finances –at which point it may be too late to do anything about it.

6. A graph maker can help you diagnose financial problems.

If your business is experiencing financial difficulties, then a graph maker can be an extremely valuable tool for trying to diagnose the problem. By analyzing your graphs, you may be able to see where in your finances things started going wrong and begin to formulate a plan for how to fix them.

7. Create a graph to help you make better financial decisions.

The data that a graph maker provides can help you make better financial decisions by giving you a more accurate understanding of what is happening with your money. For instance, if you know that a particular expense always causes your profit margin to drop, then you can make adjustments accordingly to make sure that the expense doesn’t cause a loss.

8. A bar graph maker can help you identify different aspects of your business.

This information can come in especially handy if you have multiple businesses –that is if your finances are separated by the business. You can use a graph maker to track how each aspect of your business is doing, allowing you to adjust what needs adjusting accordingly without interfering with the other parts of your business that may be doing just fine as they are right now.

9. A graph maker can show you where your time and attention should be focused for maximum benefit.

For instance, if one part of your business is bringing in more revenue than another part even though it takes up less of your time during the day, then you may want to focus more of your time on that part of the business. This is because it is more profitable for you to do so.

Conclusion

So, as you can see, there are many benefits to using a graph maker for your finances. It can help you work out what is happening with your money, plan for future expenses, and diagnose financial problems. Additionally, it can help you make better financial decisions and identify which aspects of your business are doing well and which ones could use some improvement. If you’re not currently using a graph maker for your finances, then I highly recommend that you start –you won’t regret it.